The OBBBA Tax Changes, Explained Simply

On 7/4/2025 the President signed the One Big Beautiful Bill Act. This bill is MASSIVE with lots of changes. I narrowed down to the ones that I believe will most likely impact you, with my POV/recommendations woven throughout. I made the headlines straightforward, so if it doesn’t apply to you, just skip to the next one.

Within the CPA community we agree we need the regs/guidance on some of these topics to correctly plan which I state where throughout. I will continue to update this as more guidance comes out.

INDIVIDUAL CHANGES

Lower Tax Brackets Are Permanent

The lower tax brackets that were put into law with the TCJA(Tax Cuts and Jobs Act) under Trump’s first presidency have now been made permanent. Summary of 2025 brackets here:

Heather POV: These are some of the lowest tax rates in US history so this is a good thing.

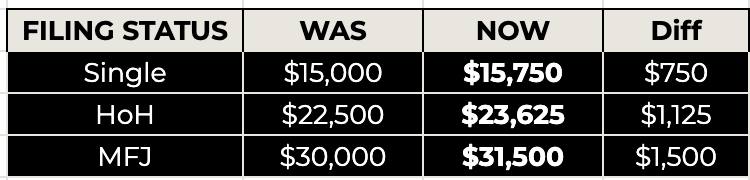

HIGHER STANDARD DEDUCTION MADE PERMANENT & INCREASED SLIGHTLY for 2025

Standard deduction = the amount you subtract from your income before calculating how much tax you owe. $100,000 income - $15,750 standard deduction = $84,250 you only owe tax on.

Townsend Planning Tip: If you are paying your kids through your business make sure you increase their payroll by $750 this year for a larger deduction for you + a higher non-taxable amount for them. :)

Age 65+ get an extra $6k Deduction (2025-2028)

Social security is still taxable! That was a mislead on social security’s part - oof! This is a $6k deduction each so a married couple gets $12k! A couple 65+ could have $46,700 of income where they pay no tax. This deduction starts to phase out at income of $75k single / $150k married. So if you are within these income limits and receiving social security yes you will be paying less tax (maybe nothing) because you are getting an extra deduction but to be clear social security is still taxable especially to those with higher incomes.

Townsend Tip: Planning will be important here in the next 4 years for 65+ to try to keep income in this range to get the extra deduction and Roth conversions should be considered.

CAR LOAN INTEREST DEDUCTION (2025-2028)

You can now deduct up to $10,000 annually of car loan interest on a NEW car bought after 12/31/2024 so 2025 onwards. The vehicle must be assembled in the US, VIN is required, a car lease does not count, it must be used personally and this deduction starts phasing out at income over $100k single / $200k married.

POV: If your income is in this range and you need a new car buy it within the next few years so you can get the deduction. Earlier is probably better so you can deduct the interest in more years as it does expire in 2028. If you use your vehicle both personally & business we are waiting on guidance on how personal vs. business use will be treated here.

SALT LIMIT INCREASED to $40K i.e. DEDUCTING STATE AND PROPERTY TAXES (2025-2029)

Only $10k was allowed for the past few years and many of my clients did get maxed out on this. This includes deducting tag renewal fees on your car (the tax portion), property taxes & state taxes paid. Income of $500k+ begins reducing how much you can deduct with income at $600k being just $10k. In 2030 it will revert back to $10k for everyone. This deduction gets increased by 1% annually. This only affects you if you itemize on your tax return i.e. have more deductions (medical expenses above 7.5% of your income, state taxes, charitable contributions and mortgage interest) than the standard deduction above.

Townsend Tip: If you make over $500k and have a business, tax planning will be important here to ensure you utilize PTE tax if available in your state to maximize deductions - i.e. paying state tax as a business expense.

NEW CHARITY DEDUCTION RULES (2026+)

If you don’t itemize you now get to deduct charitable contributions of $1k single / $2k MFJ

If you itemize there is now a floor that limits how much you can deduct - .5% of your AGI. So contributions that exceed .5% of your income you can deduct. Example your AGI is $250k and you contribute $2,000 to charity ($250k x .5% = $1,250 floor) so you only get to deduct $750! ($2,000 - $1,250 floor).

POV: This does make me sad for the people that donate a high % of their income and are high earners. We need people contributing to charities and should just get the full deduction. I like that non-itemizers are going to receive a small benefit now though!

TRUMP SAVINGS ACCOUNT for kids (2026+)

This is definitely one where I am waiting for more guidance! It seems that this will be similar to an IRA for kids, but has different rules than the standard IRA like doesn’t require that the kid have earned income or interrupt IRA contribution maxes. The part I really want guidance on is what exactly is a qualified withdrawal and how will withdrawals be taxed. Once I know that then I can plan. Here is what I do know:

Kids born 1/1/2025-12/31/2028 get funded with $1k and apparently accounts will automatically be opened by the government for these kids

Starting 7/4/2026 contributions will be allowed for an annual max of $5k (2027+ the max will be adjusted for inflation)

Contributions are not tax deductible

Kid must be US citizen & have a SSN

Investments will be limited to mutual funds & ETFs tied to a US Index

No withdrawals before age 18

No tax on earnings or qualified withdrawals (10% penalty for non-qualified withdrawals)

Odd one on this: Employers can contribute up to $2,500 tax-free for employees/dependents if have a written plan document < if it’s a tax deduction for the business this is definitely something I will consider implementing for my business owner clients. Again want more guidance

TF Planning Tip: Until I know more I’m not changing any of my client’s plans. 529s will most likely still be best for college savings and I will prefer a Roth IRA for kids over this. If money is coming out of your ears than maybe we consider this, but not until more guidance comes out will I be changing any plans.

TIPS & OVERTIME (2025-2028)

TIPS: $25k deduction max (Phases out at AGI of $150k/$300k MFJ). Must be reported on W-2 or self-reported on Form 4137. You must have a job that is ordinarily tipped (servers, hair stylists, valets etc.)

OVERTIME: $12.5k single/$25k married annual limit. (Phases out at AGI of $150k/$300k MFJ). Hourly workers only i.e. must be wages that normally require overtime to be paid. Must be reported on W-2 Box 19 (this will be a new box on the W-2)

Can take both overtime & tip deduction

TF Planning Tip: Note this is for income tax so FICA will still apply (social security & medicare tax).

ENERGY CREDITS GONE

Pay attention to the expiration dates:

30% Solar, Wind & Geothermal & Batteries expires 12/31/2025

Energy efficient home improvements (insulation, doors, windows, waters heaters etc.) expires 12/31/2025

EV Car (new & used) expires 9/30/2025

EV Charger expires 6/30/2026

Townsend Planning Tip: If you were planning on getting an EV car or putting solar on your house or upgrading your appliances/house with energy efficient items do it now before the credits expire!

MORTGAGE INTEREST DEDUCTION CHANGES

Mortgage insurance is going to be deductible again starting in 2026. Mortgage insurance comes into play when you put down less than 20%.

Mortgage interest including HELOC on up to $750,000 TOTAL of debt is made permanent on a home thus if you have $1M of debt on your home you can’t deduct all your interest

HELOC interest is only deductible if used to build or improve your home i.e. not if you use it to go buy a car

Estate Tax Limit Increased to $15 Million (2026+)

This is per person so $30M per married couple and indexed for inflation.

POV: This is now just an ultra wealthy problem, but don’t forget states can have lower estate tax limits than federal (WA, RI, OR, MN, NY, IL to name a few).

ITEMIZED DEDUCTION REDUCTION FOR HIGH INCOME INDIVIDUALS (2026+)

Itemized deductions will start being reduced for those in the $37% tax bracket - that is $626,350 single / $751,600 married in 2025. This begins in 2026 though.

INCREASED AMT (ALTERNATIVE MINIMUM TAX) EXEMPTION (2026+)

First off let me explain what AMT is - it’s a separate tax calculation limiting certain deductions and tax breaks and you must pay whichever tax is higher (regular vs. AMT). It’s a way the IRS makes sure you pay a minimum amount of tax and can be a gotcha. The AMT exemption phases out at higher limits ($500,000 for single filers and $1,000,000 for joint filers). <At these income levels proper tax planning will need to be had.

OTHER CHILD CHANGES

Child tax credit got increased by $200. Found this immaterial for its own headline.

529 Changes - The amount allowed for K-12 expenses is increased from $10,000 to $20,000. In addition, the list of eligible education expenses was expanded to include credential/apprenticeship programs & tutoring.

POV: Happy about this. The 529 continues to to get more options for withdrawal including the transfer to a Roth IRA for kids after 15 years in the Secure Act 2.0. Why I have them for my own kids.

BIG STUDENT LOAN CHANGES

Many income driven repayment plans were removed including the SAVE plan (2028) which was created during Biden’s presidency. If you were on SAVE and receiving forbearance that is ending 8/1! There are going to be 2 income driven repayment plans RAP & IBR. RAP is for lower income individuals ($100k) and not available until July 1, 2026. Right now if you have to get on a plan it’s Old IBR, PAYE (PAYE is going away) or New IBR. Standard is also available if you don’t want your payment calculated based on our income. New IBR is probably the best if you are eligible depending on when you took loans out and your income/family size.

Other items

Changes in casualty losses for Federally or State declared disasters from 1/1/2020-7/4/2025 where you can take a loss (think LA fires)

BUSINESS CHANGES

100% bonus depreciation

This is for property placed in service after 1/19/2025 and made permanent. This is huge for businesses and those that are buying rental properties/Airbnbs. It was 40% so a 60% jump to 100% for a deduction is huge.

1099 Filing requirement now at $2,000

Used to be $600 you had to file a 1099 for any contractor now it’s if you pay them $2,000+.

POV: Great for small businesses - you have enough to track and with inflation this makes sense this threshold got increased.

20% QBI (QUalified Business Income) Deduction is now permanent

This is great news for business owners and there are increased phase out ranges for higher-income business owners.

CHANGES TO MEALS DEDUCTIBILITY (2026+)

Meals provided to employees at the office including snacks are NO longer deductible. :/

These remain the same:

Meals provided to the public, for holiday parties, annual picnics for employees still 100% deductible.

Business meals at restaurants outside the office stay at 50% deductible

Other Items

Section 179 taxpayers may expense up to $2.5M. Phases out if spends more than

$4M on qualifying property. (2025+)

Research & Development Expenses now deductible again for small businesses (< $31million average sales) retroactive to 2022 so can amend or deduct all unamortized expenses in 2025. This is a big deal to those that were affected and running scenarios with your tax team will be key!

Opportunity Zones are now permanent

Increased credit for employer child care facilities

Expands the Qualified Small Business Stock (QSBS) tax break so if your company could qualify for this make sure you are aware as this could be huge tax savings for you!

Many business solar credits end in 2026

Again this bill is massive as you can see from the length of this blog post. More information will come out and I’ll continue to update here.

Hope this was helpful. As always, let me know if you have any questions.