Providing fiduciary tax-smart wealth management tailored to you.

Services & Fees

Comprehensive Financial Planning & Investment Management

Plans Include:

A custom financial plan with action items

Retirement Planning

Tax planning and management

Estate planning coordination

Asset Protection

Investment Management & Risk Monitoring

Business Planning

Philanthropy Planning

Outpacing inflation

Generational Wealth Transfer & Family Governance Strategies

You can trust Townsend Financial as a member of your team.

You’re the CEO of your life and we’re your personal CFO.

rates starting at:

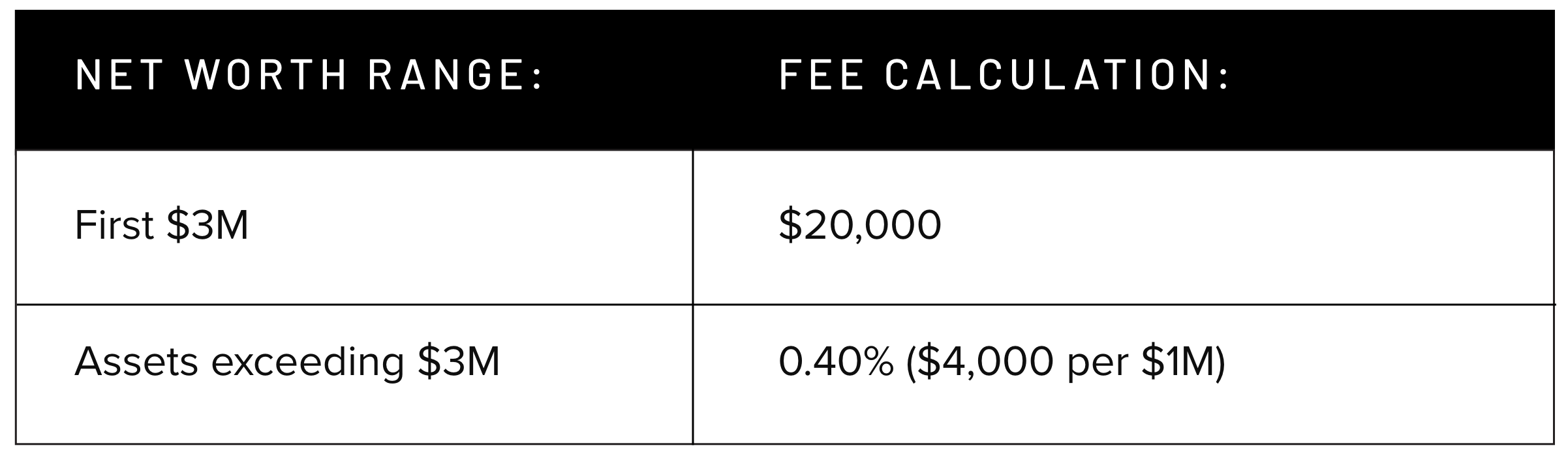

Annual Planning Fee is based on net worth and complexity with a minimum of $20,000/year.

Note: Net worth excludes primary residence and business valuation.

Fees listed above are annualized, billed quarterly or monthly in advance. Fees may adjust based on complexity.

Tax Prep

Tax preparation is offered only to financial planning clients for an additional fee. We only prepare individual tax returns.

Clients will be notified in January of each year to opt-in to this service.

Fees start at $700

Working with Townsend Financial

A quick breakdown of the planning process and timeline to getting started:

Ready to take the next step?

Schedule a 30 minute Complimentary consultation to get your financial life aligned.

FAQs

-

Financial Planning goes beyond investing. It looks at all the aspects in your financial life - asset allocation, expenses, company benefits, retirement savings, investments, debt structure, salary/income, taxes, estate planning, financial goals, insurance, tax brackets, to name a few. Financial planning ensures that every area of your financial life is in sync with your goals, and your assets are maximized. Investments are certainly important but only one piece of the pie. If the other pieces aren't working with your investments a lot of opportunity is missed.

-

A fiduciary is someone who took an oath to always act in their client’s best interests at all times. Heather is a fiduciary and believes that is what all clients should receive with their financial planning.

Townsend Financial is fee-only meaning the firm is compensated only through the fees charged to clients. We do not receive any commissions or sell any products, so there are never any conflicts of interest.

-

This stands for CERTIFIED FINANCIAL PLANNER™ and is a professional certification with rigorous requirements in education, examination, ethics, and experience in order to obtain this title. Every CFP® is trained in 72 areas of financial expertise and must accrue thousands of hours of experience prior to earning certification.

-

This stands for Registered Life Planner®. When financial plans are built around a client's true ideal life, that is financial planning done right! This year-long certification program requires three separate programs, including the psychology of money and incorporating life planning into a financial planning practice, followed by a six-month mentorship.

-

This stands for Certified Exit Planning Advisor and is a specialized professional designation for advisors who help prepare business owners for a successful exit, sale, or transition of their company. Earning the CEPA credential requires completing an intensive program, passing a comprehensive examination, and adhering to strict ethical and educational standards. CEPAs are trained in the Value Acceleration Methodology™, integrating financial, tax, legal, business, and personal planning to help owners grow transferable value and exit on their terms.

-

If you’re trying to beat the market or find the next hot stock, we’re probably not a match. Townsend Financial is focused on long-term, sustainable financial planning, not a quick-fix. See investment philosophy here.

-

Townsend Financial typically works with successful business owners and/or high net worth individuals across the country with a complex financial life. They want to live their best lives now and in the future.

Our clients typically have a net worth between $5M and $30M and are looking for a trusted, personalized, advisory relationship. Read more in About You.

-

Townsend Financial’s fees are transparent and understandable - exactly how fees should be. You can view rates here.

-

Concierge practice means we keep our client list small by design at Townsend Financial. We aim to provide highly tailored plans and customized service to each client, and our smaller client list offers us flexibility and responsiveness.